Take Five aims to help you to confidently challenge any requests for your business’s personal or financial information or requests to transfer money to another account which may belong to a criminal.

The impact of fraud and scams on businesses can be detrimental. Many struggle to recover from the severe financial and reputational damage it can cause.

Businesses of all sizes are at risk of fraud and scams and some small and medium sized businesses may have limited resources, no regular training in place on how to identify and avoid fraud and scams and have a less clear split between work and home life, with the use of work laptops at home and personal mobile phones used at work.

Criminals’ use of social engineering tactics through deception and impersonation scams involve the criminal posing as a genuine individual or organisation and contacting the victim using a range of methods including via the telephone, email and text message. Criminals also use social media to approach victims, using adverts for goods and investments which never materialise once the payment has been made.

The most common way for criminals to target businesses is through CEO scams where a criminal impersonates your boss or a senior manager to either make an urgent payment or change payment details for a contract or supplier and invoice and mandate scams when criminals pose as a regular supplier and persuade you to change the bank account details you hold on file. You’re then tricked into sending money to the account which is controlled by a criminal rather than the genuine supplier.

Can You Spot Fraud? Quiz

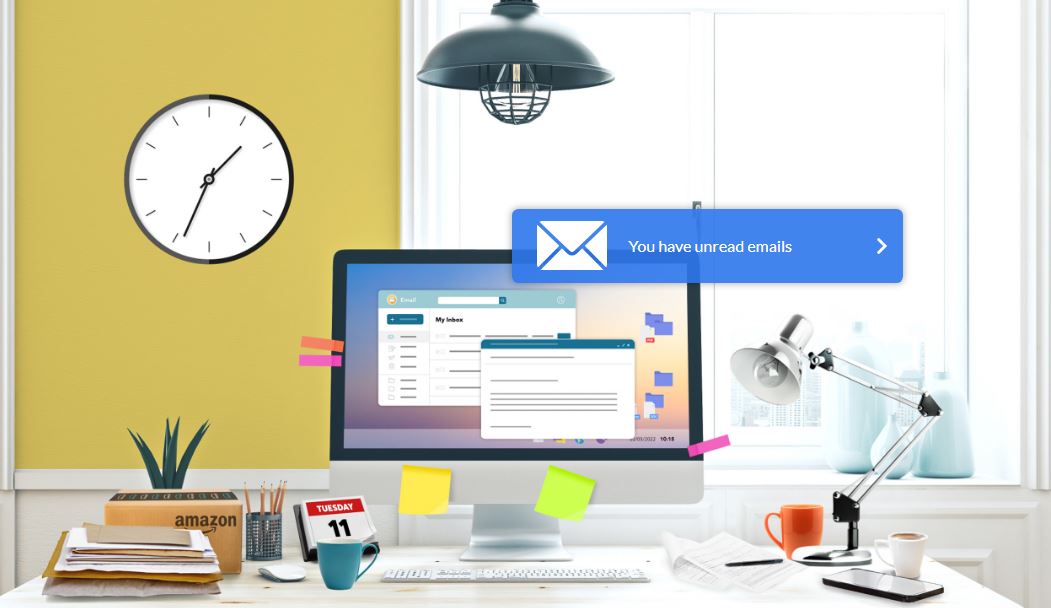

Take Five to Stop Fraud has collaborated with Amazon, which has 85,000 UK small and medium sized businesses (SMEs) selling on its store, and provides free support and guidance to more than 600,000 UK SMEs through its Amazon Small Business Accelerator. Together we have created the ‘Can You Spot Fraud?’ quiz which will provide businesses with the confidence, knowledge, and ability to protect themselves against fraud and scams.

The quiz shows users how to confidently challenge situations where criminals may be targeting their business. Recreating a busy office environment, the training takes users through a series of potentially fraudulent situations. It aims to give people the knowledge and ability to spot real-world scam calls, texts, emails and social media posts.

LET’s Go